Customer Risk Rating

Process for accessing the level of risk associated with individuals or entities used in financial crime compliance and AML practices.

Entity Hero by ZIGRAM is a risk evaluation solution to classify customers by anti-money laundering risk levels using customizable inputs and integration for onboarding, monitoring, and eKYC.

What is Customer Risk Rating (CRR)?

Customer Risk Rating (CRR) is a structured process used by financial institutions to assess the financial crime risk posed by a customer. It evaluates both inherent and residual risk throughout the lifecycle of the relationship. It assigns a quantifiable risk score or category based on multiple factors, including customer type, geography, transaction behavior, ownership structure, and exposure to sanctions, PEPs, or adverse media.

Entity Hero enables institutions to perform automated, multi-factor customer risk assessments by consolidating identity data, ownership structures, risk signals, and adverse intelligence into a single, continuously updated risk profile.Why is Customer Risk Rating (CRR) crucial for financial institutions?

Customer Risk Rating (CRR) sits at the core of a risk-based AML framework. Regulators globally expect institutions to demonstrate that customer due diligence, transaction monitoring, and ongoing reviews are proportionate to customer risk. Key reasons Customer Risk Rating (CRR) is critical include:

- It supports compliance with global AML/CFT regulations and FATF’s risk-based approach.

- It determines the depth of due diligence (CDD, EDD, or simplified measures).

- It drives alert prioritization and transaction monitoring thresholds.

- It reduces false positives by aligning controls with actual customer risk.

- It enables defensible regulatory reporting and audit readiness.

- It helps identify customers requiring enhanced monitoring or remediation.

Without an effective CRR framework, institutions risk regulatory penalties and operational inefficiencies. They may also be exposed to money laundering or terrorist financing activities.

What are the key risk factors used to determine CRR?

Customer Risk Rating is typically derived from a combination of static and dynamic risk factors. Each factor is weighted according to the institution’s risk appetite and regulatory obligations. Common CRR risk factors include:

- Customer type (individual, corporate, trust, NGO, shell entity)

- Ownership and control structure, including UBO transparency

- Geographic risk, based on country of residence, incorporation, or operations

- Industry or business activity, especially cash-intensive or high-risk sectors

- Sanctions, PEP exposure, and adverse media presence

- Product and service usage, including cross-border or high-value transactions

- Transaction behavior patterns, volume, velocity, and anomalies

- Delivery channels, such as non-face-to-face onboarding

Entity Hero enriches CRR calculations by integrating sanctions data, PEP databases, adverse media intelligence, and corporate linkage analysis, ensuring risk scores reflect both direct and indirect exposure.

Should there be sector-specific considerations in the CRR framework?

Yes, a one-size-fits-all CRR model is no longer acceptable under modern regulatory expectations. Different sectors exhibit distinct financial crime typologies, transaction behaviors, and regulatory risks. Sector-specific CRR considerations may include:

- Banking & Payments : Velocity, cross-border flows, correspondent relationships

- Crypto & Virtual Assets : Wallet risk, anonymity, regulatory arbitrage exposure

- Casinos & Gaming : Cash intensity, junket relationships, player profiling

- Trade & Corporates : Trade-based money laundering indicators, complex ownership

- Fintechs : Digital onboarding risks, API-driven transactions, scalability concerns

Incorporating sector-specific risk logic ensures CRR scores are contextual, defensible, and aligned with real-world risk exposure rather than generic assumptions.

Which are the main risk categories in the CRR framework?

Based on cumulative risk scoring, customers are typically classified into three primary categories:

a) Low Risk

Customers with transparent ownership, low-risk geography, predictable transaction behavior, and no negative risk indicators. These customers are usually subject to simplified due diligence and standard monitoring.

b) Medium Risk

Customers with moderate exposure due to geography, industry, transaction complexity, or limited adverse indicators. Enhanced monitoring and periodic reviews are required to detect risk escalation.

c) High Risk

Customers with significant exposure to high-risk jurisdictions, complex ownership structures, PEP connections, sanctions proximity, or adverse media require enhanced due diligence, senior management oversight, and continuous monitoring.

Customer Risk Rating (CRR) categorization is essential for ensuring proportional controls and regulatory compliance.

What are the best practices in Customer Risk Rating (CRR) score calculation?

To build a regulator-ready and scalable CRR framework, institutions should follow these best practices:

- Use risk-weighted scoring models aligned with institutional risk appetite

- Combine static onboarding data with dynamic behavioral indicators

- Apply clear, explainable logic for score thresholds and category mapping

- Continuously update risk scores based on new alerts, media, or transactions

- Ensure full audit trails and score change justification

- Validate and recalibrate models periodically to reflect emerging risks

- Integrate CRR outputs directly with transaction monitoring and case management

Entity Hero supports best-practice Customer Risk Rating (CRR) by offering transparent scoring logic, automated risk refresh, and full auditability, enabling institutions to demonstrate explainable and regulator-aligned customer risk assessments.

Core Features of ZIGRAM's AML Customer Risk Rating (CRR) Framework

- Single Customer & Entity View : A unified 360-degree view of customers and entities across KYC, risk, transactions, and interactions

- Real-Time Adaptive Risk Scoring : Customer Risk Ratings update dynamically as risk factors change

- Multi-Dimensional Risk Assessment : Risk evaluated across geography, transactions, behaviour, and relationships

- Centralized Case Management : Rule-based case routing with full case history and audit trails

- No-Code Rules & Continuous Updates : Configure scoring logic easily while customer profiles update automatically

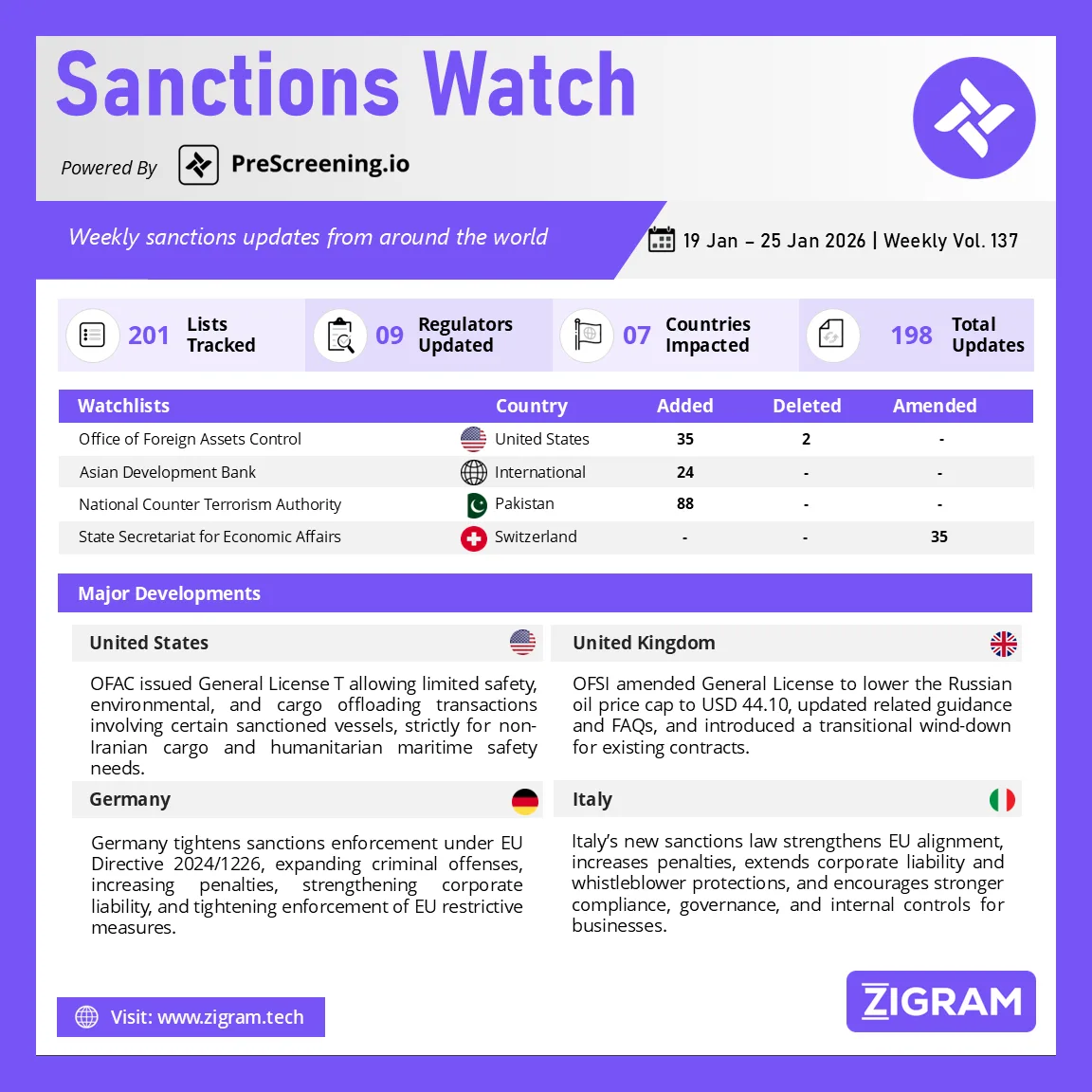

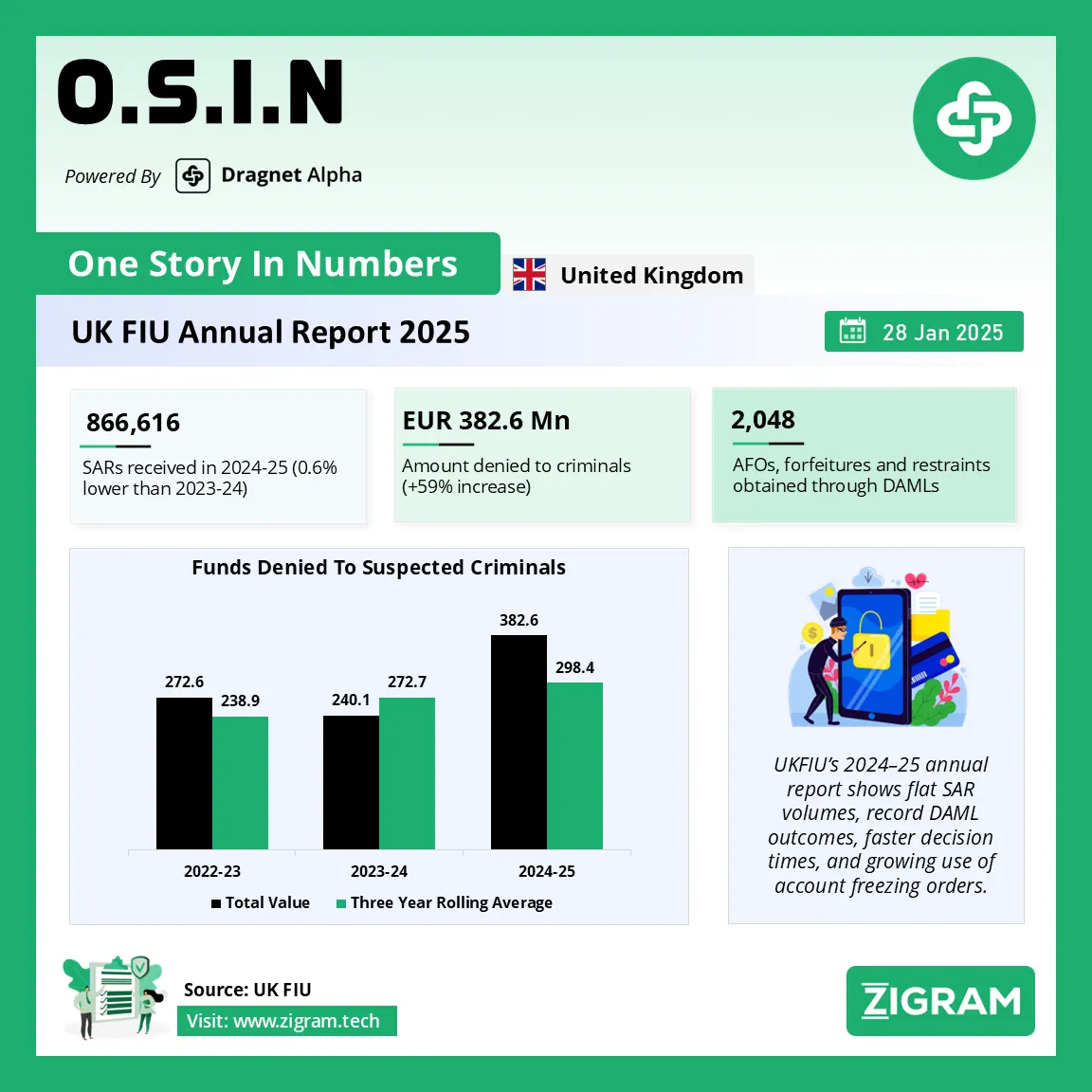

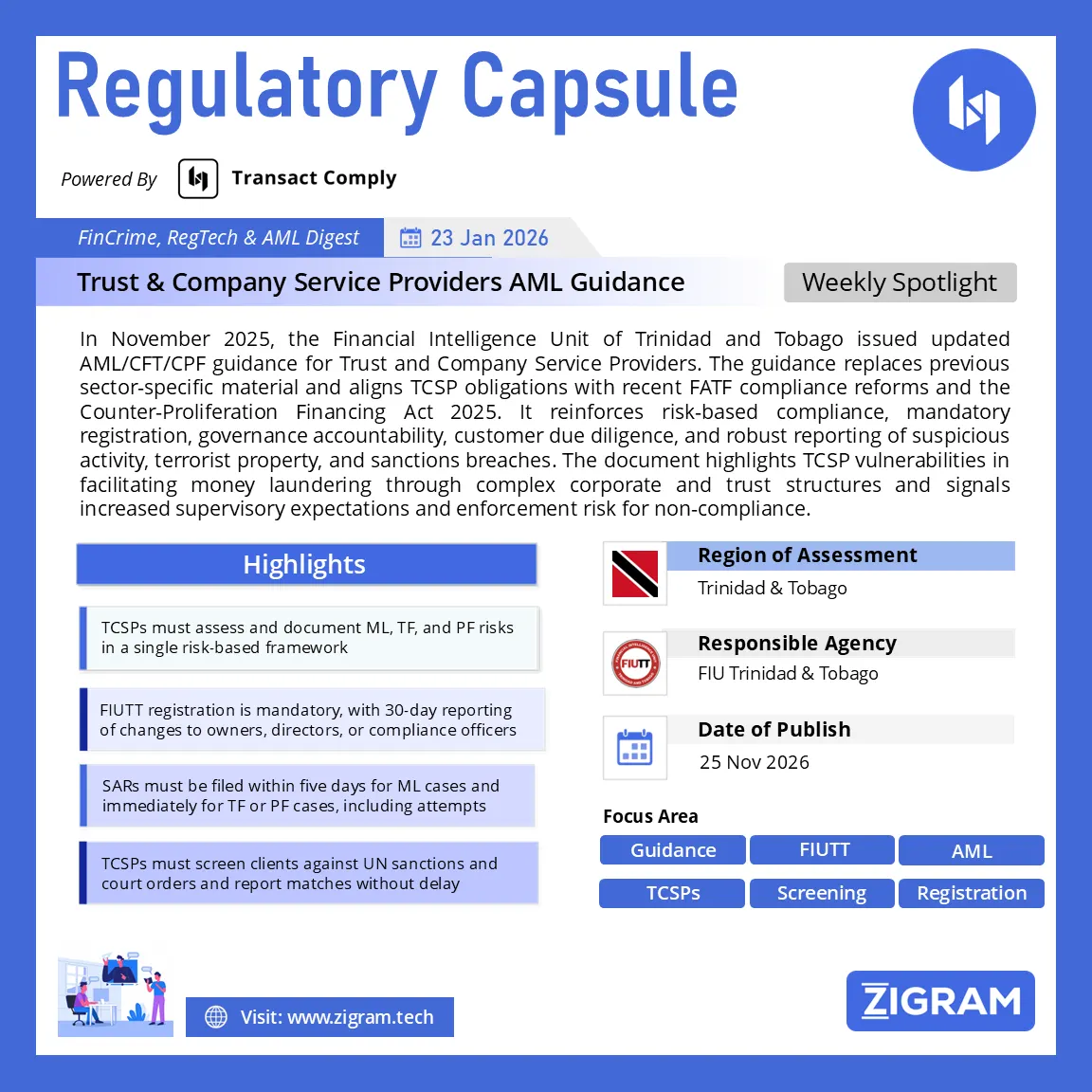

- Integrated Risk Intelligence : Native integrations with PreScreening.io and Transact Comply enrich CRR outcomes

- Alerts, Reporting & Access Control : Real-time alerts, custom MIS reports, RBAC, and end-to-end audit trails

Book A Demo

Fill out the form and our team will connect with you

FAQs for Customer Risk Rating (CRR)

What is Customer Risk Rating (CRR) in AML?

Customer Risk Rating (CRR) is an anti-money laundering (AML) process used to assess and classify the level of money laundering and financial crime risk posed by a customer or entity. It assigns a risk score or category based on predefined risk factors such as customer type, geography, transaction behaviour, ownership structure, sanctions exposure, PEP status, and adverse media.

Why is Customer Risk Rating important for AML compliance?

Customer Risk Rating enables financial institutions to apply a risk-based approach to AML compliance. It helps identify high-risk customers early, determine appropriate levels of due diligence, prioritise monitoring efforts, reduce false positives, and meet regulatory expectations under global AML/CFT frameworks.

What risk factors are used to calculate Customer Risk Ratings?

Common risk factors include customer type, country risk, transaction behaviour, product usage, delivery channel, adverse media exposure, sanctions, and PEP status.

How often should Customer Risk Ratings be updated?

Best practice is continuous or real-time Customer Risk Rating updates. Risk scores should automatically adjust based on changes in customer behaviour, transaction activity, screening results, adverse media, or emerging regulatory risk indicators throughout the customer lifecycle.

How does Entity Hero support Customer Risk Rating?

Entity Hero provides adaptive, real-time CRR scoring using multi-dimensional risk inputs, unified customer profiles, configurable rules, and seamless integration with screening and transaction monitoring systems.

Can Customer Risk Rating be customized by sector or regulation?

Yes. Modern AML regulations expect Customer Risk Rating frameworks to be tailored to an institution’s risk appetite and sector-specific risk exposure. Entity Hero enables configurable CRR models for sectors such as banking, fintech, payments, crypto, gaming, and trade finance.

How does Customer Risk Rating help reduce false positives?

Customer Risk Rating assesses customers across multiple risk dimensions and continuously updates their risk scores based on behavior and transactions. This helps separate genuine financial crime risk from normal activity, improving alert accuracy, reducing unnecessary investigations, and boosting operational efficiency.

Is Customer Risk Rating required by regulators?

Yes. Financial regulators worldwide mandate a risk-based AML approach, and Customer Risk Rating forms the foundation for Customer Due Diligence (CDD), Enhanced Due Diligence (EDD), transaction monitoring, and ongoing customer reviews in line with global AML/CFT standards.

FAQs for Customer Risk Rating (CRR)

What is Customer Risk Rating (CRR) in AML?

Customer Risk Rating (CRR) is an anti-money laundering (AML) process used to assess and classify the level of money laundering and financial crime risk posed by a customer or entity. It assigns a risk score or category based on predefined risk factors such as customer type, geography, transaction behaviour, ownership structure, sanctions exposure, PEP status, and adverse media.

Why is Customer Risk Rating important for AML compliance?

Customer Risk Rating enables financial institutions to apply a risk-based approach to AML compliance. It helps identify high-risk customers early, determine appropriate levels of due diligence, prioritise monitoring efforts, reduce false positives, and meet regulatory expectations under global AML/CFT frameworks.

What risk factors are used to calculate Customer Risk Ratings?

Common risk factors include customer type, country risk, transaction behaviour, product usage, delivery channel, adverse media exposure, sanctions, and PEP status.

How often should Customer Risk Ratings be updated?

Best practice is continuous or real-time Customer Risk Rating updates. Risk scores should automatically adjust based on changes in customer behaviour, transaction activity, screening results, adverse media, or emerging regulatory risk indicators throughout the customer lifecycle.

How does Entity Hero support Customer Risk Rating?

Entity Hero provides adaptive, real-time CRR scoring using multi-dimensional risk inputs, unified customer profiles, configurable rules, and seamless integration with screening and transaction monitoring systems.

Can Customer Risk Rating be customized by sector or regulation?

Yes. Modern AML regulations expect Customer Risk Rating frameworks to be tailored to an institution’s risk appetite and sector-specific risk exposure. Entity Hero enables configurable CRR models for sectors such as banking, fintech, payments, crypto, gaming, and trade finance.

How does Customer Risk Rating help reduce false positives?

evaluating customers across multiple risk dimensions and continuously updating risk scores based on behaviour and transactions, Customer Risk Rating helps distinguish genuine financial crime risk from normal activity. This improves alert quality, reduces unnecessary investigations, and increases operational efficiency.

Is Customer Risk Rating required by regulators?

Yes. Regulators globally require financial institutions to implement a risk-based AML approach, where Customer Risk Rating is a foundational requirement for Customer Due Diligence (CDD), Enhanced Due Diligence (EDD), transaction monitoring, and ongoing customer reviews under global AML/CFT standards.

Articles

Explore insightful articles on cutting-edge topics like regulations, technological advancements, and critical insights into AML and financial crime risks

Resources

Our weekly dose of knowledge on the latest developments in anti-money laundering, financial crime, and other offenses, including news, regulations, and reports from around the world

LEARN MORE

Let's Find the Right Solution for You

Discover how our technology and data solutions can accelerate your compliance goals.

Explore Our Solutions

Explore Our Solutions Request Custom Pricing

Request Custom Pricing Schedule A Free Trial Or Demo

Schedule A Free Trial Or Demo